First Circuit Clarifies What a “Full and Fair Review” Means to a Denied ERISA Disability Claim

The Employee Retirement Income Security Act, which governs employer sponsored benefits like disability insurance, is not friendly to the very people it is designed to benefit – you! However, one of the saving graces in ERISA are the ERISA claim regulations which require that a denied policy holder or plan beneficiary be given a “full and fair review” during the claim review process.

Let me tell you a typical story so you understand the games the disability plans or carriers play. Ms. Jette was a legal assistant who had back problems for which she underwent back surgery.

Jette was paid short and long- term disability benefits and even applied for and was granted Social Security disability benefits. But the disability carrier, United of Omaha, was done paying benefits. As is customary, United of Omaha had Jett’s claim reviewed by two medical reviewers, who never examined her, and, as expected opined that she could do her sedentary job as a legal assistant.

Jette appealed and specifically asked that United provide her with any new medical opinions that United obtained and to provide those to her 30 days before the appeal period ended so she could address those opinions in her appeal.

What Did United Do with Jette’s Request for Updated Medical Opinions?

United told Ms. Jette to stick it because they didn’t have any obligation to provide her with any updated opinions it had gotten, and they weren’t going to give her those updated opinions. Of course, United refused to give her the report of their liar for hire not so independent medical examiner, Dr. Thompson, before it issued the final denial. Dr. Thompson had opined that Jett could “engage in seated activities with occasional standing and sitting.”

She filed a lawsuit in federal district court and argued that the failure to provide her with the report and an opportunity to respond deprived her of a “full and fair review” of her claim. The federal district court agreed with Mutual because Mutual had not relied on Thompson’s report to find a new reason to deny the claim but had used the report to buttress its earlier conclusions she could do sedentary work.

Ms. Jette did not give up and she appealed the federal district decision to the First Circuit.

What Did the First Circuit Court Do with the “Full and Fair Review” ERISA Disability Argument?

The First Circuit judges were not impressed with either Mutual or the federal district judges. The ERISA regulations provide that a claimant must be provided all documents that were “submitted, considered or generated in the course of making the benefit determination,” whether or not “it was relied upon.”

The First Circuit, in Jette v. United of Omaha Life Ins. Co., 2021 WL 5231971 (1st Cir. Nov. 10, 2021) held that:

1. The “full and fair review” regulations applied to the initial appeal and the determination on appeal,

2. Mutual’s refusal to provide the report of Dr. Thompson violated the regulation and deprived her of any opportunity to respond to Dr. Thompson’s report,

3. Mutual had to provide her with a copy of the report even if the report did not provide a new reason for the claim denial .

4. Jette was prejudiced by Mutual’s failure to provide the report,

5. Mutual had to provide her with the report and an opportunity to respond to the report, and

6. Mutual had to make a new decision.

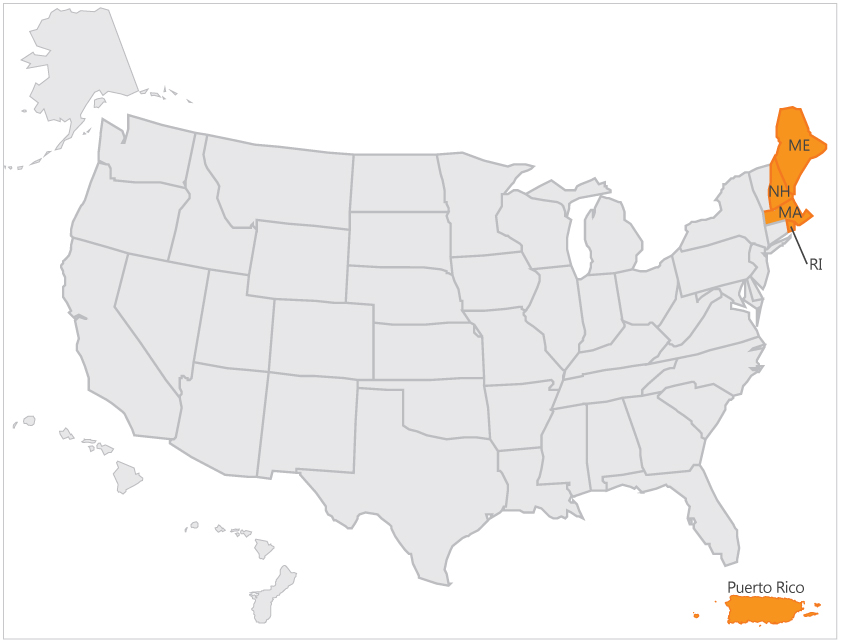

This was a great win for Ms. Jette and for all disabled policyholders taking on a wrongful claim denial or termination in the 1st Circuit.

Why Cavey Law For Your Disability Insurance Claim?

Nancy Cavey knows firsthand the fight with a disability insurance company to get the disability benefits a policy holder deserves. Her appeal letters are 25 to 60 pages long and take on every reason that the carrier has used to wrongfully deny or terminate a claim, including the “full and fair review” argument.

Nancy Cavey

– specializes in disability law and has taken on disability insurance carriers across the nation.

– recovered millions in disability benefits for her clients.

– can submit your disability insurance claim, appeal a wrongful denial or termination, file a lawsuit in federal court and negotiated a lump sum settlement.

Call today at 727-894-3188 for a free consultation and learn more about your rights to your disability insurance benefits.